Buying Services For Property Investment

Make a Sustainable Investment

Become part of the 0.1% of property investors, building a sustainable property empire by treating property like a business, supported by multiple data, trends and statistics, with sophisticated lending strategies.

When buying property for investment purposes, this does not mean buying a property down the road because you walk through a suburb and think you know it. It also doesn’t mean buying a new property for tax purposes. You are after a growth asset, not a home to live in. This should be a purely financial investment, not an emotional one.

By treating property like a business, you consider every aspect of your investment to emerge with the strongest result. We cast our net Australia-wide to find you the perfect investment property, where you don’t have to sacrifice growth to get high rent. This key distinction forms the foundation for a bespoke property investment strategy, tailored to suit your unique life situation, budget and goals.

Successful property investing demands so much more than mindset, data analytics and due diligence. When building a portfolio, there is a ‘why’ and a ‘way’. The ‘way’ is dependent on your strategies and goals, and it is based on my considerable expertise as a property investor.

Your job is to educate yourself, at both micro and macro levels. My job is to facilitate this. Guiding you on your property journey, we work together to expand your knowledge, build a powerful strategy, and make extraordinary things happen. When you think property, you need to think business

using the strategies that only the 0.1% know.

property data analytics

By using our data trends and statistics, we can help you find the best suburbs for investment and ensure that your investment will continue to grow in value over time. What we look for when assessing a suburb:

1) Identifying Immediate pressure – suburbs that are experiencing immediate pressure grow quickly and offer investors the potential for immediate returns on their investment.

2) Long-term growth prospects – even if a suburb is not currently experiencing pressure, it is important to assess its long-term growth prospects. This includes looking at factors such as population growth, inventory/supply addition or approvals, demographics, infrastructure development and job opportunities.

3) Cost of living – while it’s important to focus on growth prospects, it’s also crucial that the cost of living in the area you are buying in is not too high, as this could hinder growth in relation to capital and rental growth.

4) Investment grade properties – the non-negotiables when buying an investment property to confirm low vacancy rates over a historical period, high owner occupier appeal and low investor levels, reasonable inventory levels with pressure not leaving the area..

lending and growth strategies

Property should be treated as a business and it is important to do your research before making any decisions. Treating property like a business is far more lucrative then mindset alone. The way you buy property and your strategy could be the difference of one property vs an empire. What we look for when building a strategy::

1) The way to buy property – the most important consideration is not what you buy but how you buy a property. 99% of investors are still trying to figure this out. The way you buy a property could be the difference between reaching 1 or 10.

2) Strategic property planning – Build growth strategies based on your individual circumstances, asset selection strategies, multiple exit plan strategies, lending strategies based of growth strategies, cashflow scenarios, leverage and growth capacity.

3) Risk mitigation – risk is based on education, how fast can you build an empire mitigating risk along the way.

4) Team Building – build a team to help you reach your property goals – buyers agent, mortgage broker, solicitors, insurance broker & accountant. A team around you streamlines the process giving you the time back that your are after while crushing your investment goals.

More than just using a simple Buyers Agent, you will be working with a

property advisor & mentor

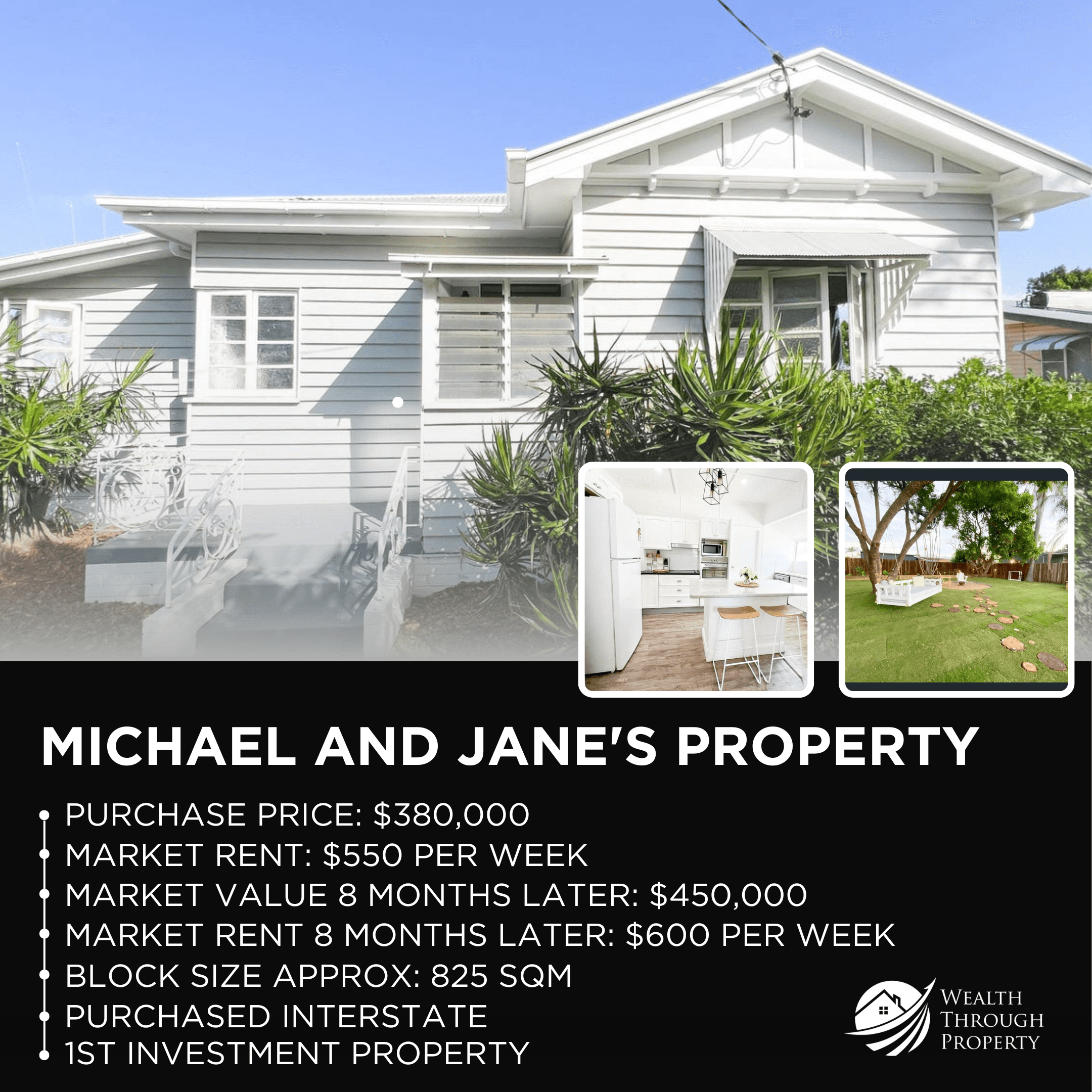

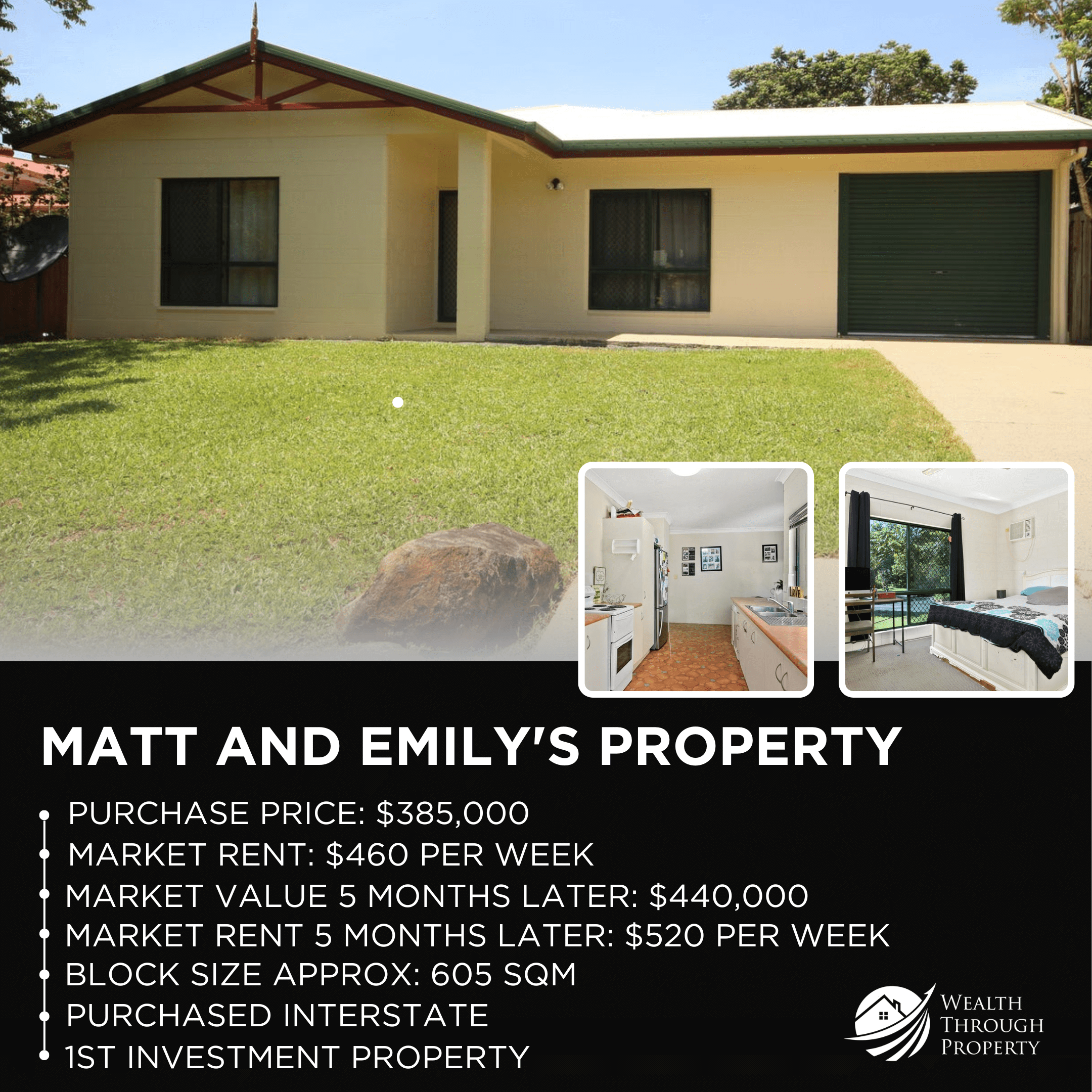

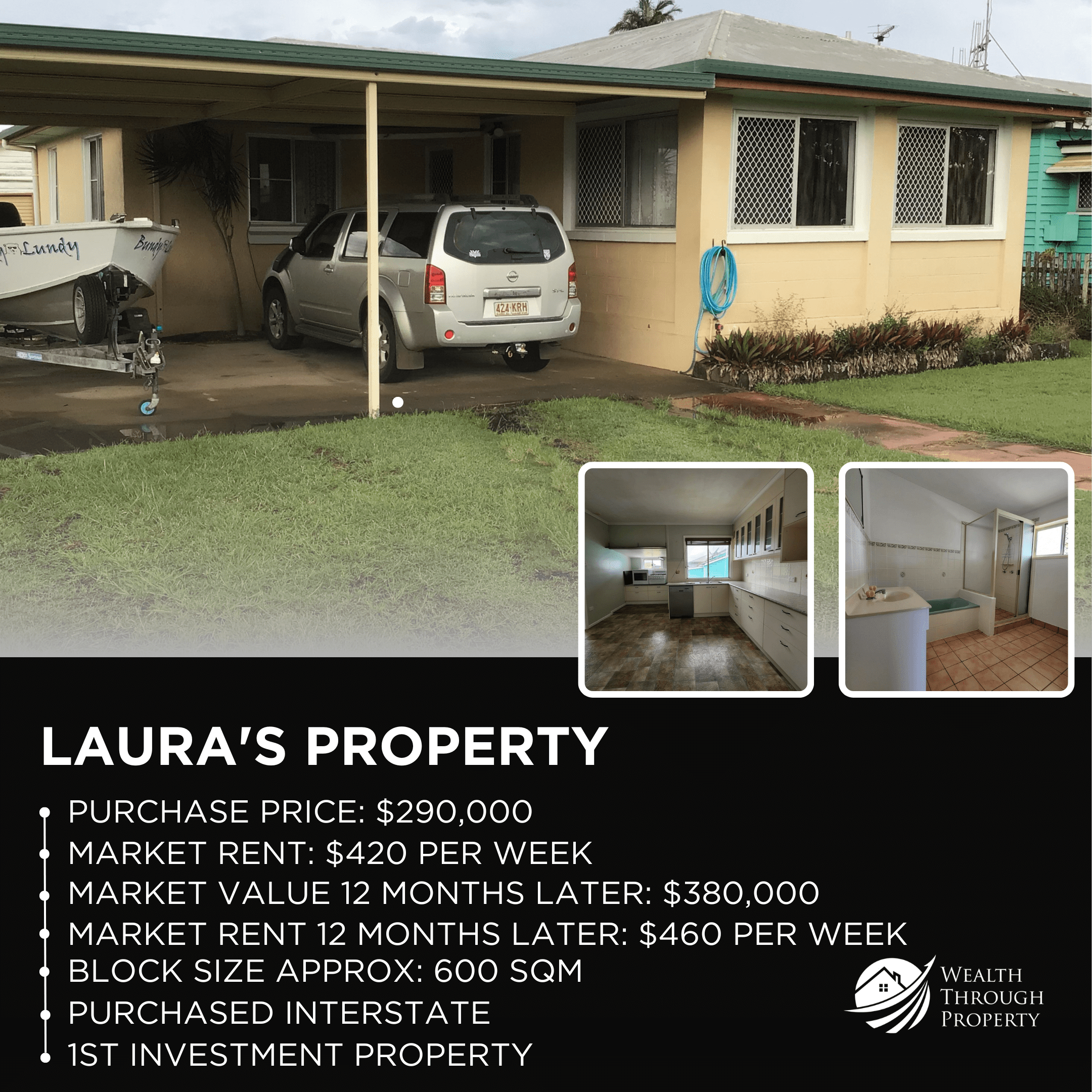

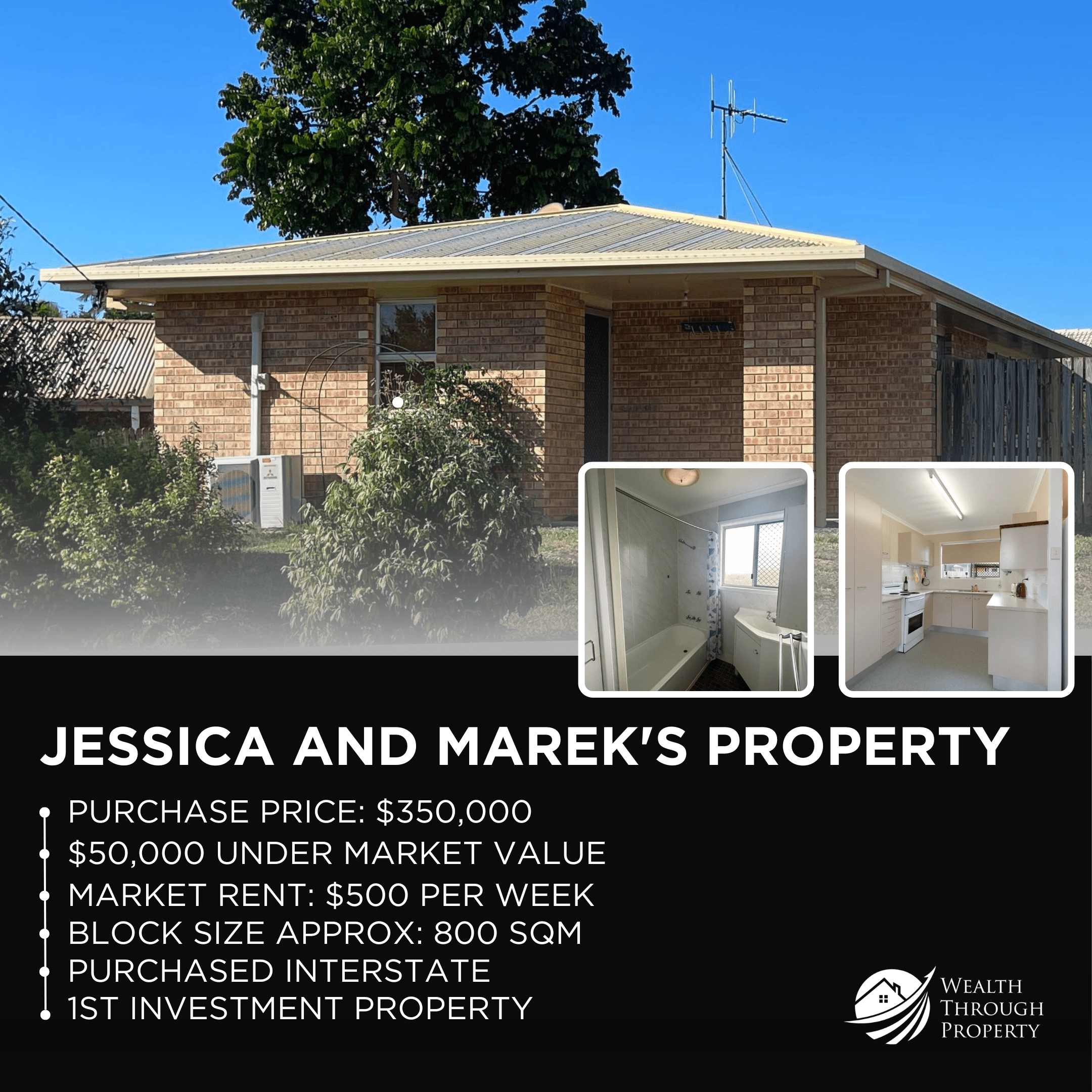

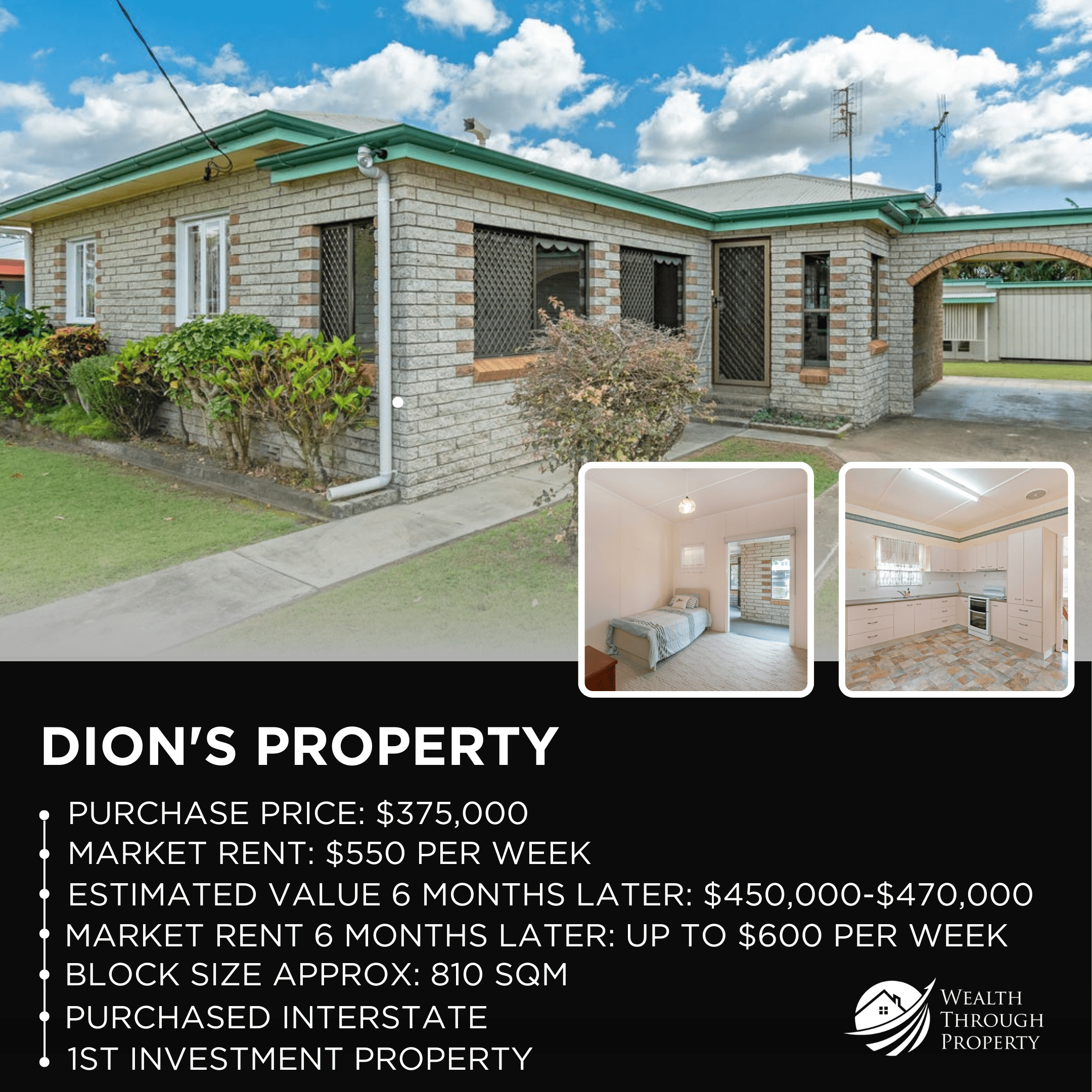

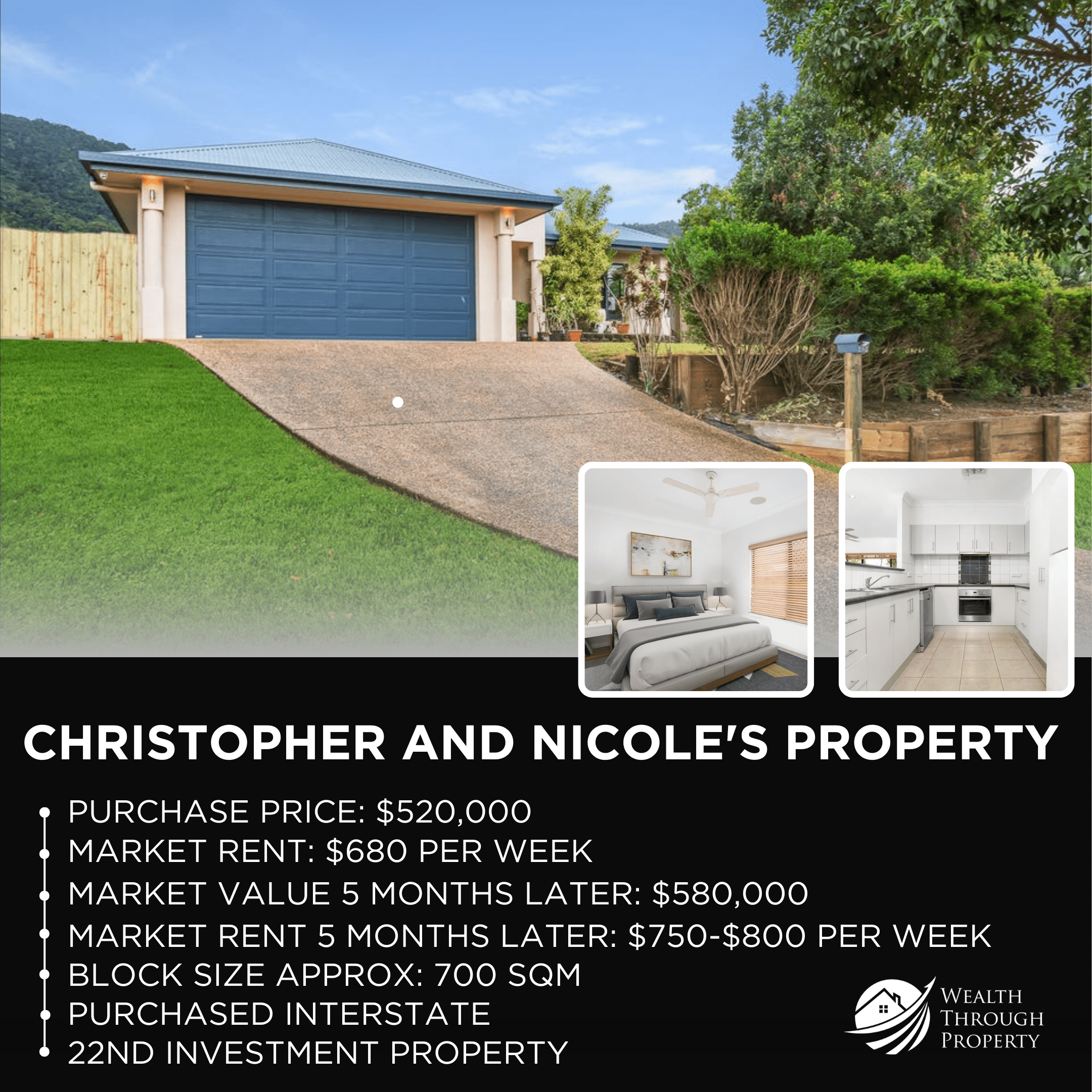

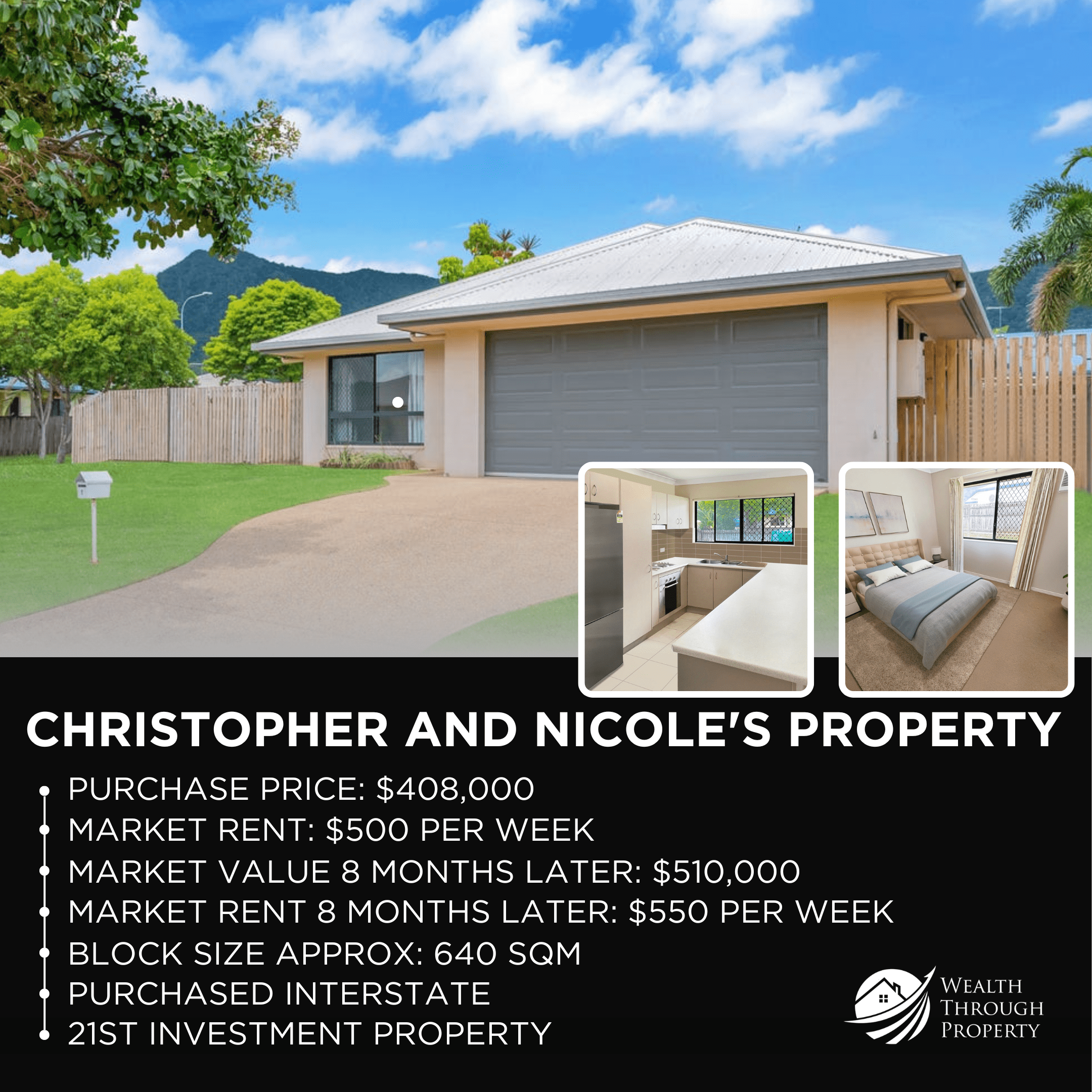

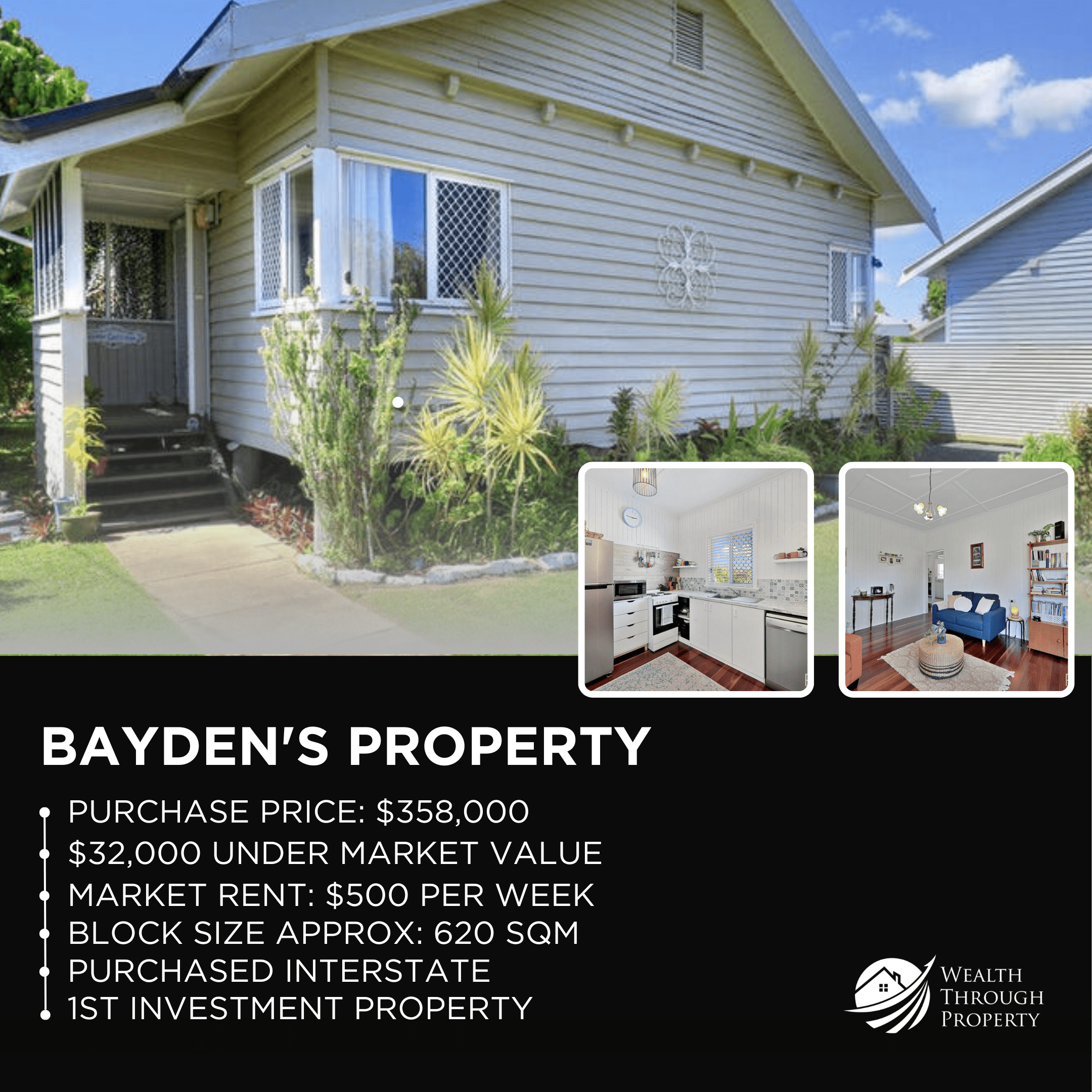

Our Clients

Our service is ideal for anyone wanting to purchase investment property or extend their existing portfolio.

Our clients range from first-home buyers to people looking at expanding their property portfolios, to people who want to build small vs large portfolios, to people who want to move quickly vs slowly, passive or aggressive.

As a licenced real estate agent and buyers’ agent of long standing, our services are popular with a wide range of individuals, couples and business people.

Whether you are feeling stuck, time-poor, overwhelmed and stressed out, keep missing out, don’t want to overpay, don’t know where to buy or keep missing out on opportunities. We can cater for your needs.

Our client’s success is the most important consideration we have when you work with Wealth Through Property. We offer an end-to-end service with support and guidance along the way. You don’t need to do this journey alone when you can have a professional in your court.

Our Process

Access the right hosts, suppliers and interior designers to make the process easier.

Choose The Right

Property For You

Use the calculator to ensure you are making the best investment decision buying your next property. This will help you calculate which property will yield the best ROI and help you to avoid making emotional decisions that can cost you thousands.

TestimonialS

Oliver Lonergan2023-10-06Scotts an absolute legend, he has guided me through the property journey. He has helped me navigate and set up great structures and I would recommend him to anyone

Oliver Lonergan2023-10-06Scotts an absolute legend, he has guided me through the property journey. He has helped me navigate and set up great structures and I would recommend him to anyone Scott Herbert2023-09-27Working with Scott has shown me new ways on how to create and grow a property portfolio instead of just buying an investment property. Scott not only has the knowledge and experience but also spends the time to teach you ways to better setup and build a property portfolio. Not only have I received value for money in my latest purchase but also in the training and knowledge that I have gained while working with Wealth Through Property. I will be continuing to work with them for future property purchases.

Scott Herbert2023-09-27Working with Scott has shown me new ways on how to create and grow a property portfolio instead of just buying an investment property. Scott not only has the knowledge and experience but also spends the time to teach you ways to better setup and build a property portfolio. Not only have I received value for money in my latest purchase but also in the training and knowledge that I have gained while working with Wealth Through Property. I will be continuing to work with them for future property purchases. David Farrell2023-09-26

David Farrell2023-09-26 Michael A2023-07-28We have been working with Scott for a few months now and have been more than impressed with his knowledge and ability. We have been able to establish professional connections ie solicitors, brokers, etc through Scott which has everyone working towards the same goal. We have definitely received value for money with our most recent purchase and look forward to us moving forward with wealth through property in the future.

Michael A2023-07-28We have been working with Scott for a few months now and have been more than impressed with his knowledge and ability. We have been able to establish professional connections ie solicitors, brokers, etc through Scott which has everyone working towards the same goal. We have definitely received value for money with our most recent purchase and look forward to us moving forward with wealth through property in the future. Jessica Wills2023-07-27Scott has been awesome throughout my journey. We bought our first investment property with Scott’s help and professional guidance. Would recommend him to any new buyers looking to kick start their investment portfolio.

Jessica Wills2023-07-27Scott has been awesome throughout my journey. We bought our first investment property with Scott’s help and professional guidance. Would recommend him to any new buyers looking to kick start their investment portfolio. Mark2023-07-26Scott’s demonstrated ability to locate investment grade properties using data , information as well as a comprehensive analysis of properties both off and on market is what sets him apart from other buyers agents. For those at any stage of their investment journey, Scott is able to review and assess your current properties/portfolio and determine a strategy to be implemented aligned with your property goals and objectives. It’s made the process of scaling my portfolio incredibly easier than if I was doing this alone and trying to select the right properties myself, relying on information I thought was the key to great asset selection. He is able to invest the time I required to be able to explain his selections and quantify this with real time figures. Almost a year on from my initial acquisition by Scott, my rent has increased by approximately 80% and capital growth of approximately $140,000. This is just one property in the portfolio. I have no hesitation in recommending Scott.

Mark2023-07-26Scott’s demonstrated ability to locate investment grade properties using data , information as well as a comprehensive analysis of properties both off and on market is what sets him apart from other buyers agents. For those at any stage of their investment journey, Scott is able to review and assess your current properties/portfolio and determine a strategy to be implemented aligned with your property goals and objectives. It’s made the process of scaling my portfolio incredibly easier than if I was doing this alone and trying to select the right properties myself, relying on information I thought was the key to great asset selection. He is able to invest the time I required to be able to explain his selections and quantify this with real time figures. Almost a year on from my initial acquisition by Scott, my rent has increased by approximately 80% and capital growth of approximately $140,000. This is just one property in the portfolio. I have no hesitation in recommending Scott. Patrick Kokavec2023-06-24As a specialist broker who focusses on assisting people build property investment portfolios, I can say that Scotts data driven approach to property selection has improved the average ROI for my clients that have purchased through him across the board. This, together with the access to a team of professionals who are all working together to achieve the best possible outcome is what sets Scott apart from the rest. Highly recommended

Patrick Kokavec2023-06-24As a specialist broker who focusses on assisting people build property investment portfolios, I can say that Scotts data driven approach to property selection has improved the average ROI for my clients that have purchased through him across the board. This, together with the access to a team of professionals who are all working together to achieve the best possible outcome is what sets Scott apart from the rest. Highly recommended MONICA ROUVELLAS2023-05-19

MONICA ROUVELLAS2023-05-19